HOW TO TALK ABOUT INCAPACITY AND HEALTHCARE?

We may not like to talk about it, but most of us will reach a point in our lives where we need more help from others to take care of ourselves. Estate Planning Attorney John Roth and Adult Care Expert Karyn Clay talk about incapacity or the physical or mental inability to manage one's affairs and the care options available in the video above and summarized below. The first question is “how do you identify when someone needs more help taking care of themselves?”, second “What the care options are for aging adults?”, and last “How you can plan and talk about care options proactively?”.

HOW DO YOU IDENTIFY WHEN SOMEBODY NEEDS MORE HELP WITH THEIR HEALTHCARE?

Almost everyone wants to live independently, in their own home, without feeling confined or burdening other people, so it’s difficult to admit or even identify when someone may need more help managing their affairs and healthcare. If you suspect that a loved one is experiencing mental or physical decline and may need more help taking care of themselves, Karyn recommends doing some detective work before asking challenging questions. Asking the adult questions about their habits or behaviors may make them defensive and feel like an interrogation, even if it comes from a place of caring. You can inconspicuously look around the house to make sure food in the fridge is not expiring, that the toothbrush is being used, that medications are being taken, etc. If you do ask the person questions, Karyn recommends keeping your tone light and making sure you know the answer to a question like “What did you have for breakfast? “, before asking it.

WHAT ARE THE OPTIONS IF AN AGING ADULT IS UNABLE TO LIVE ON THEIR OWN?

So what if you’ve done your detective work and decided that you have a loved one who needs more help. Karyn explains that the common response is to jump to “Mom has to move in with us” or “Dad should go live in a facility”, but there are many other more gradual options to consider. For those who just need help getting places, a first step might be to have a friend or neighbor regularly take them to their appointments or do a weekly grocery run for them. There are also professional agencies who can be with them for longer periods of time in their own home, who can help with bathing, meals, and other activities of daily living. The larger step from there would be entering a day program and ultimately entering a 24-hour care facility if they need that level of care. Many times having a parent or loved one move in with you seems like the best option, especially financially, but being a caregiver is a very stressful job and may not be best for all families. Also, each person has different health and social needs, that may not be met moving into a family home. Karyn recommends doing your research and looking at all the options in the area before jumping to a decision. Th the U.S., we have the Area Agencies on Aging where you can learn about care options for aging adults.

WHAT CAN BE DONE IN ADVANCE TO HELP MAKE DECISIONS ABOUT CARE CHOICES?

Although many people do their estate planning proactively, to designate who controls or gets their assets after their lifetime or in case of incapacity, the same foresight is not common when it comes to care choices at the end of life. Karyn admits that it would be great if people put more thought and planning into how they want to be cared for before they need help. Karyn recommends thinking about, then talking to loved ones about what the options in your community are and what appeals to you.

Have you ever started to try to have this conversation and it abruptly ends with “Oh, don’t worry about that” or “Just push me off a cliff”? People often go to the extreme or the joke when incapacity is brought up, because it’s uncomfortable to think about our mental or physical decline. It makes things much easier down the road if your family knows what your options and wishes are before having to make decisions for you. If having a conversation is too difficult, then writing down your wishes is a good option, so that at least there’s some sort of road map.

In meeting with adult children to do their estate planning we often hear that they feel obligated to take care of Mom or Dad, because “that’s what they did for us”. On the flip-side, when talking to clients with adult children, very few people seem to want their adult children to have to take care of them. Karyn adds that parents, generally, don’t want to put any burden on their children in becoming their caregiver, but adult children feel guilty for sending their parents to a facility. Cognitive and physical decline are never easy to approach, but a lot of stress can be saved by talking about the options and preferences of an aging adult before decision need to be made.

WHAT ABOUT INCAPACITY & ESTATE PLANNING?

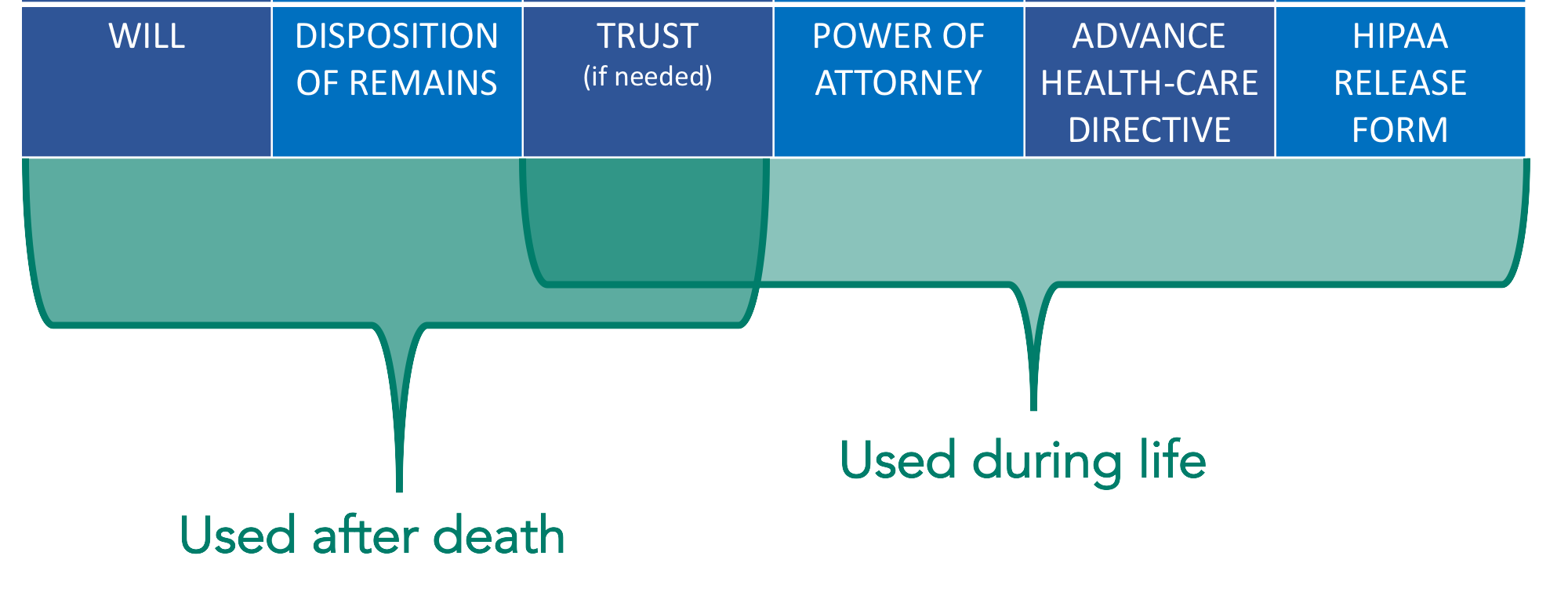

While Karyn focuses on the healthcare when incapacity becomes and issue, our job as estate planners is to create a legal framework to make sure your wishes are carried out in case of your incapacity. One of the first questions we ask at the first client meeting is “who would you like to make important decisions for you in the event of incapacity?” In preparation for the possibility of not being able to make healthcare decisions for yourself, many people choose to give a durable power of attorney to a trusted family member. Others use a trust for this purpose. The former approach is relatively simple and inexpensive; the latter is less prone to abuse. In any event, an Advance Health-Care Directive lets you make important healthcare decisions ahead of time. You can also authorize someone else to make such decisions. Most people prefer a carefully thought-out combination of these two approaches.

The best estate plan is what an informed person decides. Everyone has a different story. Until you sit down with an attorney, it's difficult to know what your options are. In most estate planning cases, the first meeting is complementary and we will give you a quote for the option you choose, before moving forward with your plan.

BIOS

JOHN ROTH

John is the founder of Hawaii Trust & Estate Counsel, a statewide Hawaii estate planning law firm with offices in Waimea, Hilo, Kona, Maui, and Honolulu. He has taught Estate Planning at the Richardson School of Law, and business law courses at the University of Hawaii—Hilo. He started “Just Ask John” as a monthly newspaper column answering commonly asked estate planning questions, in the North Hawaii News, then in The West Hawaii Today. Now it’s an online blog and video series. ....MORE

KARYN CLAY

Karyn Clay is the Founder, Executive Director, and Gerontological Specialist at Ho`onai Adult Care Services, Inc. Karyn Clay began her career in the aging field at Ocean View Care Home in Cayucos, California. She quickly decided to major in Gerontology at San Diego State University and completed her Internship at Kona Adult Day Center in Kealakekua, Hawaii. It was during that Summer program in 1997 that Karyn realized her dream to open a Care Home in Waimea. In 1998, she graduated from SDSU and, within a few weeks, had moved permanently to the Big Island. Her experience spans long-term care, home health, residential care and adult day care....MORE

MAKE AN INFORMED DECISION

Estate Planning is necessary because, as the old expression goes, "You can't take it with you" and you never know what's going to happen in life. The estate planning documents of an advance health-care directive, power of attorney, and sometimes a trust help someone step into your shoes to make decisions on your behalf, during your lifetime. Then after your lifetime, you may need a will or will substitute, such as a revocable living trust, if they want to control who inherits their property and how and when that inheritance is received, to minimize administration costs, and to avoid unnecessary taxes. A well-planned estate is a gift to your loved ones and provides you peace of mind. It is part of your legacy.

Everyone has a different story and should have a unique estate plan. In most cases, the first meeting with one of our attorneys is complementary and serves the purpose of understanding your goals and educating you on your options. Depending on the option that is right for you, we will give you a price quote at the first meeting, before moving forward with your plan. Feel free to explore the basic information on our website.

This blog does not contain legal advice. You should not rely on this to determine what is in your own best interest. For legal advice, specific to your situation, you must meet with an attorney. All posts are based on hypothetical scenarios, not the actual circumstances of real clients.

What assets should you put in your trust? Avoiding probate, planning in case of incapacity, and making things as easier for loved ones after your death are all things to consider.